Ultimate Guide to Digital Credit Applications

Every day, countless B2B deals stall in credit purgatory.

Sales teams close deals only to watch prospects disappear into weeks-long approval processes filled with incomplete PDF forms, missing bank statements, and endless email chains. Meanwhile, competitors with faster onboarding capture the business that should have been yours.

The culprit?

Legacy credit applications that were designed for a world of fax machines and filing cabinets—not the digital-first buyers who expect Amazon-level experiences in every business transaction.

Smart B2B companies are abandoning these outdated workflows for digital credit applications that turn weeks of friction into hours of seamless automation. The results are immediate: faster approvals, higher conversion rates, and customers who actually complete the process instead of abandoning it halfway through.

This isn’t just about digitizing paperwork. It’s about reimagining how businesses evaluate and onboard new customers in an era where speed and accuracy are directly correlated with your competitive advantage.

If you’re ready to reap the benefits of a seamless online credit application experience, here’s everything you need to know, from how digital credit applications work to how to evaluate and onboard the best technology for you.

What is a Digital Credit Application?

A digital credit application is an automated, online system that allows businesses to apply for trade credit through a streamlined digital workflow.

Unlike traditional paper-based processes, online credit applications collect, verify, and process customer information in real time, enabling faster credit decisions and improved customer onboarding.

Customers fill out their application online, providing business details, financial information, and references through a single interface. Digital credit applications make it easy to fill in required fields accurately and efficiently, and allow for quick corrections or updates if needed. The system automatically verifies this data against multiple sources—including credit bureaus, banking institutions, and corporate registries—conducting company verification, financial stability checks, and creditworthiness evaluation to deliver a complete, decision-ready profile to credit teams.

The Difference between Digital and Traditional Credit Applications

To review a business for credit worthiness, information has to be collected from multiple sources: banks, references, the business itself…the list goes on.

Traditionally, this has meant customers print forms, scan documents, and submit incomplete applications that bounce between sales and credit teams for weeks, leading to delays, data gaps, and frustrated customers.

Online credit applications eliminate these friction points by providing:

- Real-time data verification at the point of entry

- Automated document collection and validation

- Instant connectivity to financial institutions and credit bureaus

- Seamless integration with existing ERP and CRM systems, streamlining the entire financing process through integrated digital workflows

- Mobile-optimized interfaces accessible from any device, with some platforms allowing for mobile submission of applications

Key Components of Digital Credit Applications

There are a few critical components you’ll find in modern systems (like Nuvo) that work together to create a seamless experience:

Identity Verification Engine: Validates business registration, principal identity, and corporate structure against government databases and third-party sources.

Financial Data Integration: Connects directly to banking institutions to pull real-time account balances, transaction history, and cash flow patterns.

Credit Intelligence Platform: Automatically retrieves and analyzes credit bureau reports, trade references, and payment history data.

Document Management System: Securely collects, stores, and processes required documentation with automated validation checks.

Workflow Automation: Routes applications through approval processes, assigns reviewers, and triggers notifications based on configurable business rules.

This is what sets the digital credit application process apart from its predecessor: Most of the slow-moving, cat-herding work it takes to gather and analyze credit, banking, and business information is streamlined through one portal. Customers can apply quickly, review terms your business is confident about offering, and get onboarded into your internal systems quickly.

The Role of Payment History in Credit Evaluation

Payment history is one of the most critical factors in the credit evaluation process, offering a clear window into an applicant’s ability to meet their financial commitments. A digital credit application platform makes it easy to collect, analyze, and assess payment history data, drawing from a variety of sources to build a complete risk profile for each applicant. By automatically flagging red flags such as late payments, defaults, or bankruptcies, the platform helps businesses identify potential risks before extending credit.

This data-driven approach allows credit teams to assess the likelihood of timely payments and set appropriate terms, including the interest rate and repayment schedule. By integrating payment history into the credit application process, businesses can make more informed decisions about which applicants to approve and under what conditions, reducing the risk of non-payment and improving the overall performance of their credit portfolio.

With real-time access to payment history and other financial data, businesses can confidently extend credit to applicants who demonstrate strong payment behavior, while taking a more cautious approach with those who present higher risk. This not only protects the company’s cash flow but also enables more competitive and flexible financing options for reliable customers.

How the Digital Credit Application Process Actually Works

This kind of software operates through three interconnected stages: a customer application process, backend verification and data analysis, and business systems integrations. By leveraging digital credit applications, companies can achieve greater efficiency and control, reduce costs, and expedite the application process to support business growth.

Let’s take a moment to go over each one.

Customer-Facing Application Process

The process begins when a prospective customer accesses your branded credit application portal. The interface guides them through a step-by-step workflow designed to collect complete information in a single session.

.png)

First, customers enter basic business information: legal name, address, industry, and contact details. The system immediately validates this data against corporate registries and business databases, flagging any discrepancies for review.

Next, customers provide financial details and connect their primary business bank account. Using secure, read-only connections, the system retrieves real-time account balances, transaction patterns, and banking relationships without requiring manual bank statements.

The application then collects information about business principals, including ownership percentages, personal guarantor details, and identity verification. Advanced systems use photo ID verification and identity matching to confirm principal authenticity.

Finally, customers submit trade references and upload any required documentation. The system automatically requests references from provided contacts and validates document authenticity through various verification methods.

Backend Verification and Data Processing

While customers complete their application, backend systems work to verify and enrich the submitted data. Credit bureau reports are automatically pulled and matched to the applicant’s business profile, with credit scores reflecting the likelihood of default and helping inform credit decisions. The system cross-references submitted information against multiple databases to identify inconsistencies or red flags. Digital credit applications also provide a digital audit trail that stands up in court.

Banking data undergoes analysis to identify cash flow trends, seasonal patterns, and potential risk indicators. NSF occurrences, overdraft patterns, and account balances are evaluated against industry benchmarks and your specific credit criteria.

.svg)

Trade reference requests are automatically sent to provided contacts, with follow-up reminders and response tracking. The system aggregates responses and presents them in a standardized format for easy review.

Integration with Existing Business Systems

Upon application completion, all verified data flows directly into your existing business systems. Customer records are automatically created in your ERP with complete, accurate information. CRM systems receive updated contact details, credit limits, and account status information.

Credit teams access a comprehensive dashboard showing the complete application package, verification results, and recommended actions based on your pre-configured credit policies. Approved customers can be activated immediately, with credit limits and terms automatically populated across all systems.

Digital Credit Application vs. Traditional Paper Applications

The differences between digital and traditional credit applications are stark across every meaningful metric that matters to B2B teams. Take a look here:

From Weeks to Hours

Traditional credit applications create multiple bottlenecks that extend approval times. Customers submit incomplete applications, requiring back-and-forth communication to gather missing information. Credit teams spend hours manually entering data, pulling credit reports, and chasing references.

Online credit applications compress this timeline dramatically. Complete applications arrive instantly with all required data verified. Credit reports are automatically attached. References are contacted simultaneously. Your team reviews decision-ready packages within hours instead of days.

The End of Manual Data Entry Errors

Manual data entry introduces errors at every stage. Customers mistype information. Staff transpose numbers during data entry. Documents get misfiled or lost. These errors cascade through your systems, creating downstream problems with customer records, credit decisions, and account management.

Digital applications eliminate most human error through real-time validation. Business names are verified against corporate registries. Addresses are validated through postal services. Bank account numbers are confirmed through secure connections. The result is clean, accurate data from day one.

ROI beyond Staff Time Savings

Traditional processes consume significant staff resources. Credit analysts spend the bulk of their time on administrative tasks instead of credit decisions. Sales teams chase incomplete applications. Customer service handles confused applicants.

Digital workflows reduce these costs by automating routine tasks. Digital bank account verification saves time and reduces errors, directly impacting money saved by streamlining the verification process and minimizing delays. Staff focus on exceptions and complex decisions rather than data entry. Faster approvals mean shorter sales cycles and quicker revenue recognition. Higher completion rates mean fewer lost opportunities.

Get Customers over the Finish Line

Traditional applications frustrate customers with unclear requirements, multiple touchpoints, and long delays. Customers print forms, hunt for documents, and wait weeks for responses. Many abandon the process entirely.

Digital applications provide a modern, intuitive experience. A custom website can be tailored to facilitate quick payments, digital credit applications, and brand personalization, all within a user-friendly and straightforward design for your specific audience. Clear progress indicators show completion status. Help text guides customers through requirements. Mobile optimization allows completion from any device. Real-time status updates keep customers informed throughout the process.

The Contrast Is Clear

Hopefully it’s becoming clear that digital credit applications deliver superior results across every dimension that matters to B2B growth and efficiency.

They help accelerate revenue, standardize data, reduce manual work, and give your team real-time insight into every buyer who wants to do business with you. With one digital flow, buyers verify their business identity, connect their bank, confirm principals, submit documents, and complete references. Many digital credit application tools even offer free access to essential features like fraud checks and status management, making it cost-effective to modernize your credit process.

The good news is that there are tools you can onboard today. Here’s what you need to know about this software and how to approach leveraging it in your business.

Essential Features of Digital Credit Application Software

The difference between basic digitization and true credit automation lies in the platform’s core capabilities.

Look for these six essential features that separate industry-leading solutions from simple online forms:

1) Integrated Verification & Fraud Mitigation

Comprehensive verification capabilities form the foundation of fraud prevention and risk management in this kind of software. The best platforms integrate multiple verification layers to ensure applicants are legitimate entities while simultaneously preventing fraudulent submissions before they enter your system.

You want to look for a verification process that includes:

This multi-layered approach catches fraudulent applications before they enter your system, protecting your business from bad actors who typically avoid workflows requiring real verification.

2) Instant Bank Insights & References

At Nuvo, for instance, advanced bank connectivity provides instant access to comprehensive financial data through secure connections to over 16,000 financial institutions (98% coverage), completely changing how businesses verify customer financial health.

Instant bank insights should include things like:

This connectivity uses secure, permissioned connections that comply with banking regulations while providing your credit team with unprecedented visibility into applicant financial health. The data quality far exceeds traditional bank statements, enabling more accurate credit decisions—and potentially more favorable terms for applicants.

3) Connected Credit Reports & Data Marketplace

Native platform integrations with major credit bureaus like Creditsafe and Equifax, plus a comprehensive data marketplace, ensure every application includes complete credit intelligence from multiple sources. This is table stakes when looking for the right tool for your team.

Bureau integration capabilities should include things like:

Connected credit reports should arrive as part of the complete application package, with ongoing monitoring capabilities to track bankruptcies, liens, and OFAC changes, allowing credit analysts to begin review immediately rather than waiting for separate bureau pulls.

4) Automated Trade References & Financial Analysis

Look for platforms that automate the traditionally manual process of collecting and analyzing trade references.

An automated reference collection could include:

An automated system eliminates manual reference collection, which can significantly reduce processing time.

5) Job Sheets & Industry-Specific Data Collection

For businesses requiring project-based or job-specific information, platforms worth your time provide structured data collection tailored to industry needs.

Look for capabilities like:

Specialized industry validation might also include:

Job sheets enable precise data collection for project-based businesses while specialized validations ensure compliance with industry-specific requirements, streamlining approval processes for complex business models. This is a must have if you work with construction and materials businesses.

6) Workflow Automation and Approval Routing

Last, but absolutely not least, you should look for tools that have native intelligent workflow automation. This ensures applications move as efficiently as possible through approval processes while also maintaining appropriate oversight and control.

Look for capabilities like:

Advanced monitoring and management features include:

Digital applications give sales and finance teams one shared view of every customer, which provides teams with the business to collaborate in real time. Sales stays informed without bothering credit teams, while comprehensive monitoring ensures ongoing risk management throughout the customer lifecycle.

Tips for Implementing a Digital Credit Application Platform

So you found the perfect tool with all of the above features.

Now what?

Successfully implementing the right system for your team requires careful planning, systematic execution, and thoughtful change management.

Here’s an implementation framework to get you started:

Pre-Implementation Planning

Start by documenting your current credit application process, identifying pain points, and defining success metrics. Many software providers will help you do this.

Map existing workflows to understand approval hierarchies, document requirements, and integration touchpoints.

Key planning considerations include:

Most platforms offer cloud-based deployment with API integrations, but verify network security, data storage requirements, and user access management capabilities match your technical environment.

System Integration and Data Migration

Most platforms offer pre-built connectors for major ERP systems (NetSuite, SAP, QuickBooks, Sage, Microsoft Dynamics) enabling automatic customer creation, credit limit updates, and real-time synchronization. Approved applications generate complete customer records with verified data that flows directly into your existing systems.

Plan for migrating existing customer credit files and application history. Historical context remains valuable for existing customers seeking credit increases or renewals, and should include customer master data, payment history, and trade reference information.

Configure user roles, access controls, and audit trails to meet security policies and regulatory requirements. Most platforms today will provide granular permission controls with comprehensive operations dashboards to track team efficiency and application processing metrics.

Team Training

Different teams require different levels of system knowledge based on their interaction with credit applications. You can use this as a general guide:

Launch Strategy

Launch in phases to ensure smooth adoption: Start with new customer applications, then existing customers requesting credit increases, and finally all applications and renewals.

Develop clear customer messaging that emphasizes the benefits: faster approval times, mobile-friendly completion, real-time status tracking, enhanced security, and elimination of paperwork. Create comprehensive support materials including guides, tutorials, and FAQs.

Monitor completion rates, abandonment points, and support tickets during early rollout phases. Use feedback to refine application flows and support materials before full deployment.

Industry-Specific Digital Credit Application Solutions

Different industries have unique credit requirements, risk profiles, and operational workflows. At Nuvo we specialize in supporting businesses in the beverage & liquor, building materials, chemicals, distribution, food service, and manufacturing spaces.

Here are some unique considerations a few of these industries may face when it comes to creating lasting trade partnerships—plus Nuvo case studies to highlight how our customers are using online credit applications to improve efficiency and customer experience.

Building Materials, Construction

The building materials and construction industry operates with unique seasonal patterns, project-based financing needs, and complex customer relationships that require specialized credit evaluation approaches.

Construction customers often need credit tied to specific projects with varying timelines and payment structures. Digital applications can capture project details, payment schedules, and completion milestones to assess credit needs accurately.

Tools like Nuvo include features specific to these needs like:

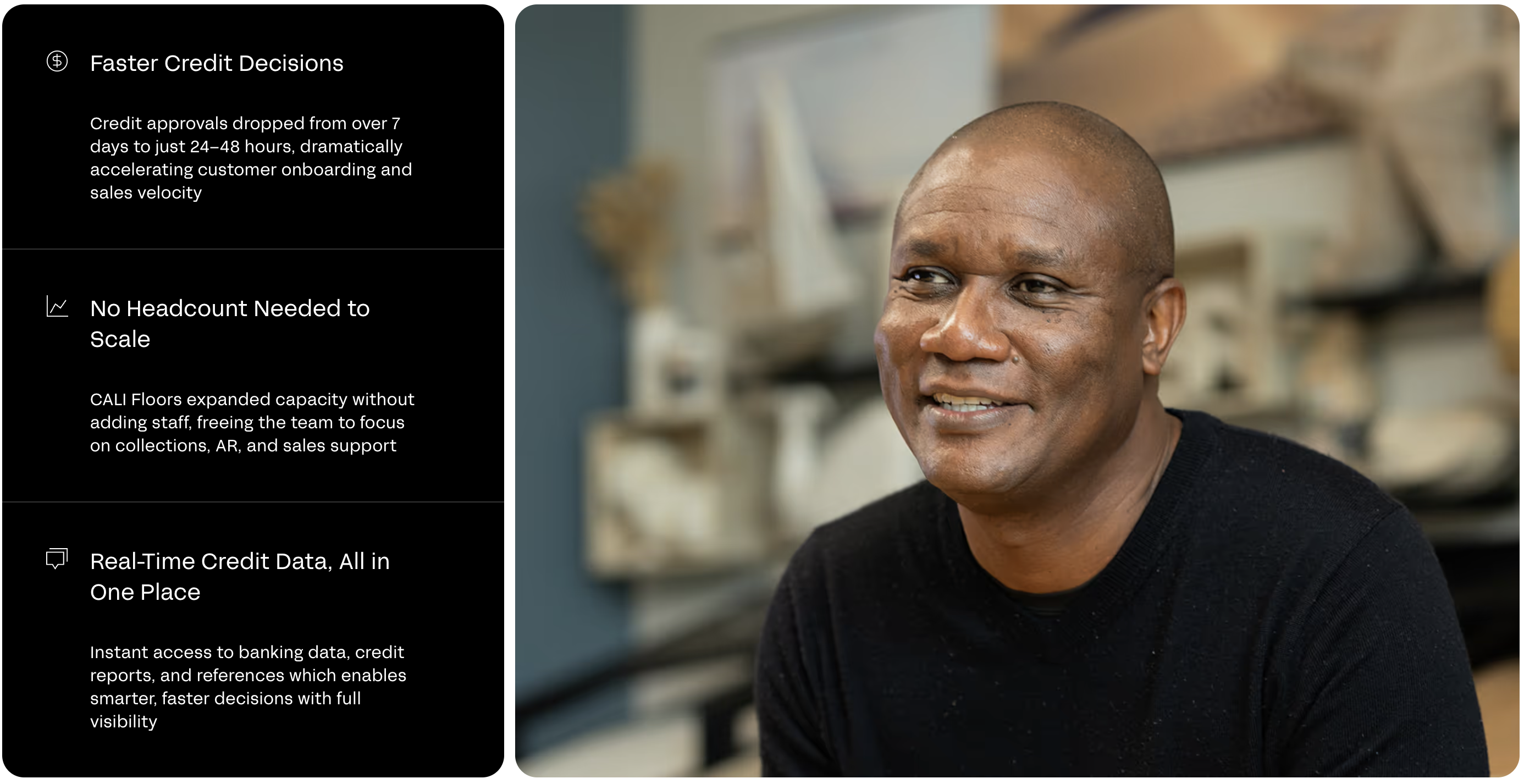

It’s features like this that brought companies like Artistic Tile, Jones Heartz Building Supply, and CALI Floors to Nuvo.

Among results like 2x personal guarantee coverage and 50% accelerated time-to-sale, these businesses were all able to significantly reduce application approval timelines, eliminate manual workflows, and take advantage of a streamlined process built for their unique processes.

Chemical and Industrial Supplies

Chemical and industrial supply companies face unique regulatory requirements, environmental considerations, and specialized customer relationships that require specialized credit evaluation approaches.

When the right software is onboarded, it can make the unique challenges faced by chemical companies easier by integrating services like OFAC checks and auto-matching with Secretary of State filings. Features like this reduce time to first sale and ensure compliance in a highly regulated space.

When leading lab management platform and equipment distributor Quartzy brought on Nuvo, they were looking for a way to extend credit on large orders without falling victim to risky customers.

Snapshot of Quartzy’s process before and after a digital credit application tool

In doing so, they not only increased their ability to offer favorable terms to their highest volume customers, their CFO Bheem Bhatia also noted that they’re “seeing credit approvals happen 50% faster than they did with Nuvo.”

In any industry where customers are eager to place large orders, extending various levels of credit is essential—without the ability to act nimbly, businesses may lose out on sales.

Food Service

Food service and hospitality businesses have unique operational characteristics that require specialized credit evaluation, including perishable inventory, high employee turnover, and location-dependent performance.

And if you’re selling to restaurants, understanding their financial standing is particularly critical when making trade credit decisions. Nearly 50% of all restaurants fail in their first five years, after all.

Digital credit application software can come in particularly handy in these scenarios, and companies like patio heater manufacturer AEI used Nuvo to better assess their customers’ credit worthiness.

Before they brought on Nuvo, AEI’s accounting manager Robyn Ortiz was in charge of their paper-first process, and review often took 2–3 weeks. Not only was this an arduous process, it also got in the way of Robyn’s other responsibilities, like monitoring customer payment behavior and adjusting credit limits.

“Now we’ve got instant access to financial history, credit scores, and automated trade references which gives us confidence to grant more trade credit,” Ortiz said about life post-Nuvo. She’s even been able to increase credit limits by 30%, giving customers more purchasing power (and AEI greater revenue potential).

For AEI, digital credit applications are giving them room to work with more customers at a higher volume, but tools like Nuvo can also support business in the food service industry with features like liquor license verification and fraud prevention.

Credit application software that’s particularly attuned to food service needs may also include features like liquor license verification and fraud prevention.

Frequently Asked Questions About Digital Credit Applications

Ok, that was a lot…

…and it would be totally reasonable to feel overwhelmed right now.

The good news is that this is what we do here at Nuvo, and we are here to help in whatever way we can.

.png)

In the meantime, here are some of the top questions that we get when it comes to switching from traditional credit applications to automated online digital credit applications:

Common Implementation Concerns

How long does implementation typically take?

For a tool like Nuvo, most teams launch in two weeks. First, the application is configured and approved, then sales and credit teams are trained in distributing the link and how to make decisions in the back end. Larger deployments with multiple ERPs may take longer, but the core setup can be quick.

Will our customers resist the change from paper applications?

Most adopt it quickly. They get a mobile-friendly flow, fewer documents to upload, and instant verification. Clear rollout messaging helps drive near-universal adoption.

What happens if customers can’t complete the digital application?

They can pause and return to the portal at any time. Your team can assist through shared dashboards, and you can offer alternate paths for edge cases without reverting to full manual workflows.

Security and Privacy Questions

How is sensitive financial data protected?

Nuvo, for instance, uses encrypted, read-only bank connections, strict access controls, and SOC 2–level security. No credentials are stored, and all data is transmitted through secure channels.

Who has access to customer information?

Only authorized users on your credit, finance, and sales teams. You control access levels and permissions, and audit logs keep track of all decisions and changes.

Integration Capabilities

Which ERP systems integrate with digital credit applications?

As long as data can move in and out of an ERP system, it can typically integrate with your digital credit application platform. This can be via API, file transfer, or native integration in the case of some cloud platforms like Oracle NetSuite or DMSi Agility.

Can we maintain our existing approval workflows?

Of course! Though, we always recommend bringing all your customers through the digital application to ensure you have consistent processes that ensure data parity across systems.

How does integration with our CRM work?

If you use Nuvo, our webhooks can be used to push data in real-time into any system, including CRMs. Additionally, Nuvo associates sales reps and notifies them of each step towards approval.

Pricing and ROI expectations

How quickly will we see ROI?

You should experience an immediate reduction in time spent processing each application and collecting references. With better insight to creditworthiness, credit teams often find they extend more credit to less risky customers and lower the chance of bad debt surprises.

Are there ongoing costs beyond subscription fees?

No, usually not! Price certainty is incredibly important to finance teams and so there are no surprise charges or hidden fees that would change your expenses.